:max_bytes(150000):strip_icc()/final_cashflowtodebtratio_definition_1102-0ee183755e0648dfa9a9027944d8a80c.png)

Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Mutual Funds & ETFs: All of the mutual fund and ETF information contained in this display, with the exception of the current price and price history, was supplied by Lipper, A Refinitiv Company, subject to the following: Copyright © Refinitiv. Data may be intentionally delayed pursuant to supplier requirements. FactSet (a) does not make any express or implied warranties of any kind regarding the data, including, without limitation, any warranty of merchantability or fitness for a particular purpose or use and (b) shall not be liable for any errors, incompleteness, interruption or delay, action taken in reliance on any data, or for any damages resulting therefrom. Source: FactSetĭata are provided 'as is' for informational purposes only and are not intended for trading purposes. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Sources: FactSet, Tullett PrebonĬommodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Sources: FactSet, Tullett PrebonĬurrencies: Currency quotes are updated in real-time. Sources: FactSet, Dow Jonesīonds: Bond quotes are updated in real-time. Sources: FactSet, Dow JonesĮTF Movers: Includes ETFs & ETNs with volume of at least 50,000.

Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Overview page represent trading in all U.S. Indexes: Index quotes may be real-time or delayed as per exchange requirements refer to time stamps for information on any delays. Copyright © FactSet Research Systems Inc. Fundamental company data and analyst estimates provided by FactSet. International stock quotes are delayed as per exchange requirements. stock quotes reflect trades reported through Nasdaq only comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. If the maturity date is in the immediate future, then it is entirely possible that a firm will not be able to pay off its debt, despite a robust cash flow to debt ratio.Stocks: Real-time U.S.

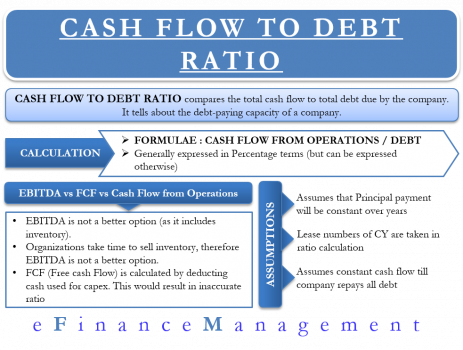

Problems with the Cash Flow to Debt RatioĪn issue with this ratio is that it does not consider how soon the debt matures.

#Operating cash flow to total debt free

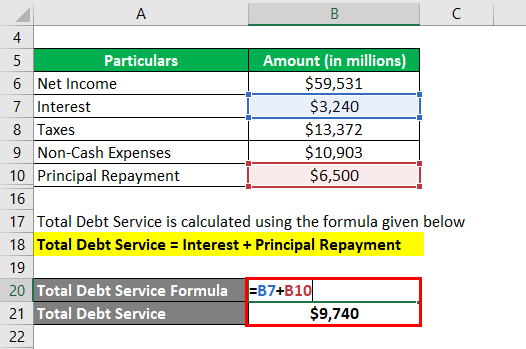

Free cash flow deducts cash expenditures for ongoing capital purchases, which can greatly reduce the amount of cash available to pay off debt. We just noted that the ratio can be calculated using either cash flow from operations or free cash flow. When evaluating the outcome of this ratio calculation, keep in mind that it can vary widely by industry. The 20% outcome indicates that it would take the organization five years to pay off the debt, assuming that cash flows continue at the current level for that period. Therefore, its cash flow to debt ratio is calculated as: Its operating cash flow for the past year was $400,000. A business has a sum total of $2,000,000 of debt.

0 kommentar(er)

0 kommentar(er)